Aadi Bioscience Signs Licensing Deal with WUXI and HANGZHOU DAC for Novel ADC Portfolio

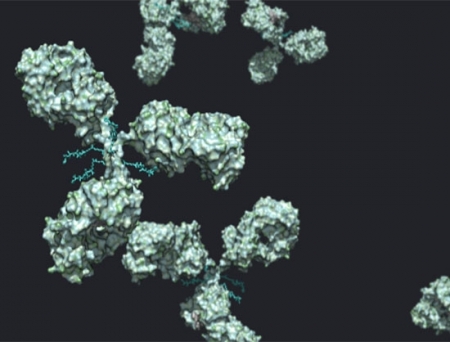

Aadi Bioscience has entered into an exclusive license agreement for development and global commercialization of a three-asset portfolio of preclinical, next-wave antibody-drug conjugates (ADCs), in collaboration with WuXi Biologics (2269.HK) and HANGZHOU DAC BIOTECHNOLOGY CO., LTD. (HANGZHOU DAC).

Per the terms of the license agreement, Aadi is granted exclusive rights to certain patents and know-how pertaining to three preclinical ADC programs leveraging HANGZHOU DAC's CPT113 linker payload technology targeting each of Protein Tyrosine Kinase 7 (PTK7), Mucin-16 (MUC16) and Seizure Related 6 Homolog (SEZ6). Aadi will pay aggregate upfront payments of USD 44 million for in-licensing such ADC programs. Additionally, Aadi is obligated to pay cumulative development milestone payments of up to USD 265 million, cumulative commercial milestone payments of up to $540 million and single-digit royalties of sales.

To support this transaction, Aadi entered into a subscription agreement with certain qualified institutional buyers and accredited investors for a private investment in public equity (PIPE) financing that is expected to result in gross proceeds of approximately USD 100 million, before deducting placement agent fees and other offering expenses. The Company is selling an aggregate of 21,592,000 shares of its common stock (Common Stock) at a price of USD 2.40 per share, representing a premium of approximately 3.4 percent to the closing price on December 19, 2024 on Nasdaq, and pre-funded warrants (Pre-Funded Warrants) to purchase up to an aggregate of 20,076,500 shares of Common Stock at a purchase price of USD 2.3999 per Pre-Funded Warrant share.

The syndicate was led by Ally Bridge Group, with participation from new investors OrbiMed, Invus, Kalehua Capital and other accredited investors, Tae Han co-founder of ProfoundBio, as well as existing investors, including Avoro Capital, KVP Capital and Acuta Capital Partners. The PIPE financing is expected to close in the first half of 2025, subject to stockholder vote and satisfaction of customary closing conditions.

"I'm thrilled to announce our partnership with WuXi Biologics and HANGZHOU DAC to bring forward this thoughtfully selected ADC portfolio. We were deliberate in identifying broadly expressed tumor targets where first-generation ADCs have already shown proof of concept. With our next wave ADC portfolio, we aim to build upon these earlier therapies to deliver improved outcomes for people living with cancer. The financing underscores the confidence our investors have in both the potential of this portfolio and the strength of Aadi's management team," said David Lennon, PhD, President and CEO of Aadi Bioscience.

Last news about this category

We use our own and third party cookies to produce statistical information and show you personalized advertising by analyzing your browsing, according to our COOKIES POLICY. If you continue visiting our Site, you accept its use.

More information: Privacy Policy